UFE Reaches Across the Northern Border

A year ago, UFE traversed the northern border of the US to Ottawa, Ontario for a visit with the largest public workers union in Canada, the Public Service Alliance of Canada (PSAC). We were invited by PSAC’s National Education Program Officer, Victoria Gibb-Carsley, who once participated in a UFE Training of Trainers Institute.

Victoria found UFE's use of popular education methodology to be highly effective, and decided it was just what PSAC needed in developing a new leadership training program. Today, PSAC's program is acclaimed as one of the most comprehensive and powerful in Canada's labor movement.

This week, Victoria shared with us the most recent outcome of our collaboration–a project that highlights the lasting impacts of UFE's work to raise awareness of economic inequality, and exemplifies the proliferative nature of a clear call for justice.

At our workshop in Ottawa last year, I shared a short video, produced by UFE volunteer, Matt Chana, called the "BBs of Wealth," which provides an illustration of wealth inequality in the US. The concept of our "BBs" video resonated strongly with the folks at PSAC, and inspired them to produce one of their own to share with their membership and use in their trainings.

PSAC's final product, “Pennies of Prosperity,” is a chilling representation of the vast Canadian wealth divide. Their video is another entry in the toolbox of educational materials that tells the story of inequality. And, it will undoubtedly galvanize many more people to become engaged in efforts for progressive social change.

Support The Responsible Estate Tax Act

Urge Your Senators to Co-Sponsor The Responsible Estate Tax Act, S.3533

Dear Friend of United for a Fair Economy,

Senators Sanders (I-VT), Harkin (D-IA), and Whitehouse (D-RI) have just proposed a strong, fair, and fiscally responsible estate tax bill. The Responsible Estate Tax Act (outlined below) would make the wealthy pay their fair share, while ensuring that the estate tax will not affect the middle class, small businesses, or family farmers. Call your Senators now and urge them to co-sponsor the Sanders/Harkin/Whitehouse Responsible Estate Tax Act S.3533 so that we can begin the path towards a fairer and more responsible tax system.

1. Call toll-free 800-830-5738 or 202-224-3121 (Capitol switchboard) and ask to be connected to your two US Senators, or call their direct lines. Then, ask for the staff person who handles taxes, or tell the person who answers the phone:

- My name is _____________. I am a constituent.

- I am calling to urge the Senator to co-sponsor S.3533 the Sanders/Harkin/Whitehouse Responsible Estate Tax Act .

- If we are going to get out of this recession, we need to end the Bush tax cuts for the wealthy. It’s time to restore the progressive tax system that made our country strong, beginning with a robust estate tax. The Sanders/Harkin/Whitehouse The Responsible Estate Tax Act is an important step on the road to an economic recovery that benefits all Americans.

- This bill is a common sense solution. It balances the desire to protect small businesses and farms with the assurance that the super-wealthy give back and support the country that made their prosperity possible.

Email me (don't reply to this email), Lee Farris, at [email protected] to let me know what you heard and how it went. If you get a reply email or a letter from your legislator, please send me a copy.

2. Write a letter to the editor. Find the editor's email from the Contact the Media box. Use the talking points above and connect your letter to any story about taxes or deficits. Please send me a copy of the letter you submit.

3. Share this alert with everyone you know. Please forward this email, post it on blogs, Facebook, Twitter, MySpace, and everywhere else you communicate.

Thanks for taking action,

Lee Farris

Senior Organizer on Estate Tax Policy

United for a Fair Economy

617-423-2148 x133

[email protected]

THE SANDERS/HARKIN/WHITEHOUSE RESPONSIBLE ESTATE

TAX ACT, S.3533

- Exempts the first $3.5 million of an estate from federal taxation ($7 million for couples), the same exemption that existed in 2009. Doing this would mean that 99.75 percent of all estates would be exempted from the federal estate tax in 2011 alone.

- Includes a progressive rate structure so that the super-wealthy pay more. The rate for the value of the estate above $3.5 million and below $10 million would be 45 percent, the same as the 2009 level. The rate on the value of estates above $10 million and below $50 million would be 50 percent, and the rate on the value of estates above $50 million would be 55 percent.

- Includes a billionaire's surtax of 10 percent. The bill also imposes a 10 percent surtax on the value of an estate above $500 million ($1 billion for couples). According to Forbes Magazine, there are only 403 billionaires in the United States with a collective net worth of $1.3 trillion. Clearly, the heirs to these multi-billion fortunes should be paying a higher estate tax rate than others.

- Closes all of the estate and gift tax loopholes requested in President Obama's Fiscal Year 2011 budget. These loophole closers include requiring consistent valuation for transfer and income tax purposes; a modification of rules on valuation discounts; and a required 10-year minimum term for Grantor Retained Annuity Trusts (GRATS). OMB has estimated that closing these loopholes that benefit the super-wealthy, would raise at least $23.7 billion in revenue over 10 years.

- Protects family farmers by allowing them to lower the value of their farmland by up to $3 million for estate tax purposes. Under current law, the value of farmland can be reduced up to $1 million for estate tax purposes under 2032(a) of the Internal Revenue Code (Special Use Valuation). The bill increases this level to $3 million and indexes it to inflation.

- Benefits farmers and other landowners by providing estate tax relief for conservation easements. The bill provides tax relief to farmers and other landowners by amending estate tax rules for conservation easements through an increase in the maximum exclusion amount to $2 million and increasing the base percentage to 60 percent.

This legislation would exempt over 99.7% of Americans from paying any estate tax whatsoever, while ensuring that the wealthiest Americans in our country pay their fair share.

BACKGROUND

The future of the federal estate tax is still up in the air. Due to the Bush Tax Cuts, there is no estate tax in 2010. However, it will return in 2011 with a $1 million exemption and a 55% rate. It is likely that the Senate will act on the estate tax by the end of the year. This is creating a pressure cooker of debate over what the estate tax should look like in 2011.

President Obama proposed keeping the 2009 estate tax, with a $3.5 million exemption per spouse and 45% rate. That loses about half as much revenue as full repeal.

As a stronger alternative to the Obama proposal, UFE has supported H.R. 2023, The Sensible Estate Tax Act, sponsored by Rep. McDermott, (D-WA)., which would set the exemption level at $2 million per spouse, and establish progressive tax rates of 45% to 55%. Because the McDermott bill has not been introduced in the Senate, UFE also supports the Sanders/Harkin/Whitehouse Responsible Estate Tax Act.

Senators Lincoln (D-AR) and Kyl (R-AZ) proposed a dangerously weak estate tax that includes a $5 million dollar exemption per individual and a 35% tax rate. This proposal would cost our cash strapped nation additional tens of billions of dollars in the coming years and would do so to the exclusive benefit of multi-millionaires.

America quite literally can’t afford the kind of estate tax that Lincoln and Kyl propose. Senators Sanders, Harkin, and Whitehouse have proposed a viable solution. Call your Senators as soon as possible and urge them to co-sponsor S.3533 the Sanders/Harkin/Whitehouse Responsible Estate Tax Act and help bring fair taxation back to America!

P.S. Remember to call toll-free 800-830-5738 or 202-224-3121 (Capitol switchboard) to support a strong estate tax, and ask to be connected to both your US Senators, or call their direct lines.

Excitingly Reasonable New Senate Estate Tax Proposal

Senators Sanders (I-VT), Harkin (D-IA), and Whitehouse (D-RI) got together to introduce a reasonably progressive estate tax proposal in the Senate. The Responsible Estate Tax Act (S.3533) is the first decent estate tax bill has seen the light of day in the upper chamber in quite a while. See our action alert in support here, and call your Senator to get them on board with this positive step for the estate tax.

On the major points, exemption and rates, the bill is mixed. The exemption would be set at $3.5 million ($7 million per couple), which is a bit higher than ideal but is the same as President Obama's proposal and the exemption in the bill passed by the House last year. S.3533 does quite a bit better than the Obama / House approved plan on the rates. The rates, in fact, are what makes the bill truly worthy of support. The bill includes a progressive rate structure from 45-55% percent and an additional surtax on estates valued over $500 million ($1 billion per couple). The progressive rates in this bill are genuinely praiseworthy.

Under the Responsible Estate Tax Act 99.7% of Americans would owe no estate tax at all.

Some more detail:

- Exempts the first $3.5 million of an estate from federal taxation ($7 million for couples), the same exemption that existed in 2009. Doing this would mean that 99.75 percent of all estates would be exempted from the federal estate tax in 2011 alone.

- Includes a progressive rate structure so that the super-wealthy pay more. The rate for the value of the estate above $3.5 million and below $10 million would be 45 percent, the same as the 2009 level. The rate on the value of estates above $10 million and below $50 million would be 50 percent, and the rate on the value of estates above $50 million would be 55 percent.

- Includes a billionaire's surtax of 10 percent. The bill also imposes a 10 percent surtax on the value of an estate above $500 million ($1 billion for couples). According to Forbes Magazine, there are only 403 billionaires in the United States with a collective net worth of $1.3 trillion. Clearly, the heirs to these multi-billion fortunes should be paying a higher estate tax rate than others.

- Closes all of the estate and gift tax loopholes requested in President Obama's Fiscal Year 2011 budget.These loophole closers include requiring consistent valuation for transfer and income tax purposes; a modification of rules on valuation discounts; and a required 10-year minimum term for Grantor Retained Annuity Trusts (GRATS). OMB has estimated that closing these loopholes that benefit the super-wealthy, would raise at least $23.7 billion in revenue over 10 years.

- Protects family farmers by allowing them to lower the value of their farmland by up to $3 million for estate tax purposes. Under current law, the value of farmland can be reduced up to $1 million for estate tax purposes under 2032(a) of the Internal Revenue Code (Special Use Valuation). The bill increases this level to $3 million and indexes it to inflation.

- Benefits farmers and other landowners by providing estate tax relief for conservation easements. The bill provides tax relief to farmers and other landowners by amending estate tax rules for conservation easements through an increase in the maximum exclusion amount to $2 million and increasing the base percentage to 60 percent.

Estate Tax Organizer Lee Farris on Revolution Boston

The government needs to generate a certain amount of revenue in taxes to fund important public services. The estate tax goes a long way toward generating this revenue. And, explains UFE's Estate Tax Organizer Lee Farris, "If the estate tax goes away altogether, the responsibility for those taxes will be shifted onto middle class people." This hardly seems fair when, according to Farris, "A family could leave $7 million tax-free to their kids, which is more than a median income worker could earn in two lifetimes."

To listen to Lee's full interview with Jeff Santos on Revolution Boston, click here (MP3).

Estate Tax Foolishness

Oh, thank goodness we, the taxpaying US citizenry, including the poor, helpless business-owning women, African Americans and "other minorities," have the courageous William Beach of the Heritage Foundation to speak on our behalf about matters of the economy. In an Illinois Business Journal op-ed debate this month, UFE's Lee Farris represented the pro-estate tax position and Beach spoke from the opposing camp.

Beach lists seven reasons to repeal the so-called "death tax," all of which are painfully unsubstantiated. Unfortunately, I only have a time to blast away at a few of his more startlingly ridiculous points.

- The estate tax discourages savings and investment. Okay, we're not talking about the low- and middle-income majority of Americans. Those affected by the estate tax are a very tiny and very wealthy sliver (less than a single percent) of the population, to whom savings and investment are not as much the practical concerns they might be for everyone else.

- The estate tax undermines job creation. Sadly, even in the absence of supporting evidence for this claim, Beach attempts to qualify it with this: "These numbers do not appear in employment statistics because the investments that would have created these jobs are never made." Umm...okay. But, I don't recall George W. Bush's $2.5 trillion tax break bonanza for the wealthiest 5% (of which repeated cuts to the estate tax were a part) doing much for job creation. Read the news much, Mr. Beach?

- The estate tax contradict the central promise of American life: wealth creation. Economic stability is important, but is wealth creation really "the central promise" of living in this country? All this time, I've completely missed that "Life, Liberty and the pursuit of Happiness" was just a long-winded way to say, "making money." I feel cheated for having thought the phrase referred to human rights and a deeper-than-monetary sense of enrichment. Silly me.

Is the Heritage Foundation even trying anymore? Or have enough of us just been politically brain-fried enough to buy into even the most pathetic of attempts to garner support for elitist causes?

UFE Faces the Heritage Foundation on the Estate Tax

Point: Why America Needs a Strong Estate Tax

By Lee Farris

"America is a tremendous nation that faces huge challenges over the coming years. Millions have lost their jobs and homes during this economic crisis, and our nation’s long-term budget is on an unsustainable path.

Despite these facts, there are still some who want to end the estate tax, which would amount

to yet another irresponsible tax break for the wealthy. Sadly, for some of our elected leaders, like Senators Kyl and Lincoln, passing new tax cuts for wealthy trust fund heirs is a higher priority than revitalizing our economy or balancing our budget.

Why do we need an estate tax? Our government plays a vital role in promoting individual opportunity and national prosperity. Simply put, taxes are the price we pay to live in a stable, secure and thriving society with a decent quality of life. The estate tax generates billions in revenue from those most able to pay. The wealthiest Americans have benefitted the most from the investments that our country has made in an educated workforce, reliable transportation, technology and a legal system that makes commerce possible.

Middle class Americans are finding fewer opportunities for success because education and other paths to advancement are increasingly out of reach. The estate tax helps to even the playing field by slowing the concentration of power in the hands of those born into great wealth. [...]"

Read the full op-ed by Lee Farris (PDF 1.1 MB) - see p. 8

Read the Counterpoint by William Beach (PDF 260 KB) - see p. 9

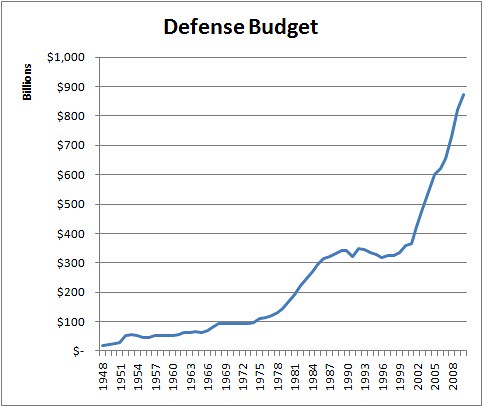

Deficit Hawks Should Eye the Defense Budget

As the debate rages in Congress between deficit hawks and legislators who want to invest money to create jobs, one important point of common ground is being overlooked. The two sides should be able to come together to responsibly downsize America’s bloated defense budget.

Conservative estimates of savings is $1 trillion between 2011-2020. Some of the savings could go to deficit reduction and some towards job creation. Best of all, it's a values-based reprioritization of America’s investments away from guns and back to butter.

Chart h/t Campaign for America's Future

Change Comes to E-News

E-News is changing, and we want your input. As part of a series of upgrades and improvements that we're making to our website, we are retooling the way we produce and present content in our E-News updates. All of our E-News stories are now available live on our website. We're posting new content throughout the month, so you can check in anytime for the latest updates.

Now that we've changed E-News, it's time to rename it. We want your suggestions on what the new E-News will be called. Take a look around. Read the stories. And shoot us an email ([email protected]) with your idea for a new name (or any other thoughts you might have about E-News).

Enjoy the new E-News and thank you for your input.

Carrying Their Own Tax Weight?: High Finance and Carried Interest

The US Senate is combing through the American Jobs and Closing Tax Loopholes Act of 2010 this week. Included in that bill is a provision to close the loophole on what's called "carried interest," which is where most of the income of hedge fund and private equity firm managers comes from.

About the loophole: mega-rich financiers' incomes are a percentage of their funds' annual profits. Our friends at Citizens for Tax Justice explain that managers of various investment partnerships are generally compensated with a "two and twenty" system–that is, they receive a 2% management fee and 20% of all profits of the investment, even if they didn't contribute any funds up front. They claim that income to be capital gains, distinct from earned income, which is therefore subject to the much lower capital gains tax rate of 15% (vs. the top income tax rate of 35 percent).

Ergo, billions of dollars are lost each year to insufficient and unfair taxation on the incomes of these investment banking leaders. Closing this loophole could generate an estimated $25 billion in federal revenue over 10 years.

Len Burman, fellow at the Brookings Institute, had this to say on NPR's Morning Edition:

"It's a huge windfall to some of the best-off people in society, [...] High-income people are supposed to be taxed at the highest rates, 35 percent, [...] But people who are lucky enough to be in the private equity or hedge fund business get their income taxed at a 15 percent rate."

Despite popular anti-Wall Street sentiments and broad, multi-class support for increased taxes on America's wealthy, closing the carried interest loophole is not guaranteed. Alan Sloan gives a personalized take in the Washington Post:

The legislation, introduced by Rep. Sander M. Levin (D-Mich.), calls for private-equity firms, venture-capital firms and real estate investment partnerships to have half their carried interest income treated as capital gains in 2011 and 2012, and 25 to 45 percent of it to be treated as capital gains from 2013 on. [...]

Next year, with tax rates on regular income and capital gains set to increase, the carried interest types' 50-50 split would give them an effective tax rate of 31 percent, rather than the 20 percent capital gains rate. Now, take me, someone who makes a (low-) six-digit income but is stuck in the phaseout bracket of the alternative minimum tax. If my income were split 50-50 next year, my rate would be 32 to 33 percent. I'm well-off, but far from rich by any definition except the Obama administration's. So my sympathy for private-equity types paying higher taxes on their carried interest income is, shall we say, extremely limited."

Some feel that this proposed tax change would stifle industries other than high finance. In the Morning Edition story we cited above, John DeBoer, president of the Real Estate Roundtable, argues that nearly half of US investment partnerships are in real estate, and that increased taxes on developers would prevent a rebuilding of the struggling sector. This and every other anti-tax argument in the context of the carried interest debate don't come as a surprise.

This particular move to even the tax playing field has and will continue to draw criticism from many different directions–including those dreaded and well-funded industry lobbyists. But, we can rest a little easier, as Linda Beale has provided a sensible analysis to help us through most of it. Here's a quick synopsis:

1) Any economic justification for privileged treatment of fund managers is absurd. (They'll still make boatloads of money, even if they have to pay taxes like average Americans.) And, this won't be catastrophic to investment partnerships. (Most of these folks aren't going to quit doing their jobs simply because they're taxed like ordinary people.)

2) Any provision that splits the rate structure (like Rep. Levin's) is arbitrary, creates undue complexity, seems to ask for folks to game the system, and would, according to Beale, only serve as a pacifier for certain high-wealth campaign contributors.

3) Any half-baked measure that continues to favor fund managers is only a sign that "the House and Senate are willing to sell out ordinary taxpayers and continue to favor the wealthy and that fairness loses when the House or Senate is thinking about campaign contributions."

4) Compromises on carried interest "makes a mockery of the basic fairness concept in taxation." Beale posits that both chambers of Congress understand that carried interest provides preferential treatment for a very small number of people, and that there is no way to justify such treatment. A failure to pass strong legislation to close the carried interest loophole is further evidence of shady dealings between special interests and our lawmakers.

The carried interest debate is but one of many, many tax debates in the pipe for the year. As with any rule or practice that's been deeply ingrained in our government or society, change becomes a battle of inches. Twenty-five billion dollars over 10 years may not be enough to leap all of our country's many economic hurdles, but it could certainly make life a little less of a struggle for millions of Americans, instead of more lavish for a few.

Financial Reform Conference Committee Excitement

Over at The American Prospect, Tim Fernholz provides a thorough rundown of how the financial reform conference committee will work. The whole piece is worth reading. If you don't have time, here's one key point:

The committee will use the Senate bill, with a few House-bill substitutions, as the default working text, which gives an advantage to reformers, since the Senate bill -- which includes the Volcker rule and tough derivatives-reform provisions -- is stronger than the House bill.

The final bill is likely to be far closer to the Senate version than the House bill, because the unified bill will again need to clear the 60 vote hurdle in the Senate but will only need a simple majority in the House.

Some key points of what is in and what will be debated are below:

Consumer Protection is in and will stay there, but whether it's a standalone Agency (as in the House bill) or a Bureau housed at the Fed (as in the Senate version) is up for debate. The likely outcome is that this hot button issue will hew closely or exactly to the Senate version in order to hold the coalition of Senators necessary to prevent a filibuster. A standalone agency is preferable, but the inclusion of meaningful protection for consumers of financial products looks like it will be one of the major victories of this effort. It's not time to celebrate until the bill is signed into law. Thanks are due to our members who raised their voices in support of it and to all of our coalition partners for getting it this far.

Say on Pay is in as well. There is nothing in either bill that will directly and concretely end the worst excesses of CEO pay and bonuses in the financial industry. Say on Pay is at least a step in the right direction. That's why we started sponsoring a series of Say on Pay shareholder resolutions last year. Our coalition helped to build momentum for the right of shareholder to have a say on the pay of top executives at publicly traded companies. It's good news that Say on Pay is about to become the law of the land for finance.

Derivatives Reform is the hottest topic for the conference committee. The Senate bill includes the Lincoln amendment on derivatives that the banks hate and one of the worlds greatest living economists loves. We know Senator Lincoln (D-AR) best for her disturbing pro-Walton stance against common sense and popular opinion on the estate tax. Her strong amendment on derivatives reform was a pleasant change of pace. Whether it makes it through the conference is one one of the more interesting questions for the bill. Whatever the fate of the Lincoln amendment, it is great news that the requirement that derivates be traded through a clearinghouse will almost certainly make it into the final bill.

More Details: Annie Lowrey has the schedule. And the Washington Post put out a nice summary of some of the differences to be resolved between the House and Senate bills. Mike Konczal has an excellent summary of some keys to what's at stake in the conference committee.

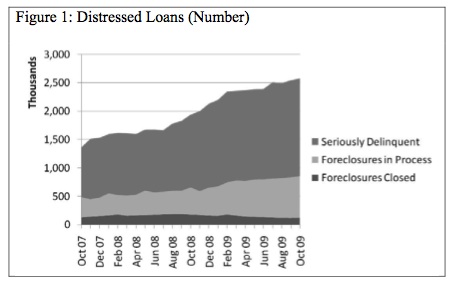

Foreclosures: Case Not Closed

Photo credit: DavidDubov

The US foreclosure crisis was cause for mass hysteria leading up to the 2008 financial meltdown, and the crisis continues to this day. Despite that, the mainstream media has recently largely ignored widespread foreclosures and the deceptive and racially-discriminatory financial practices behind many of them.

Being that the housing bubble was the flimsy core of this Great Recession—and it has resulted in the biggest loss of wealth to communities of color in US history, we’d like to see this issue paid all due attention.

Today, we’ve got the good, the bad and the ugly on the foreclosures situation. We’ll start with the ugly so we can end on a high note.

The ugly: Subprime loans were at the epicenter of the initial stage of the foreclosure crisis, and even now, foreclosure rates are holding steady at high levels that are not expected to drop any time soon. Last month, we learned that one-tenth of all US mortgages are delinquent. Of those who’ve managed to hold onto their homes, one in four is “underwater,” meaning they owe more than their house is actually worth (January 2010 data).

Chart h/t Rortybomb

Communities of color are most impacted by this prolonged crisis, because high-cost home lending was racially targeted. People of color—including many who solidly qualified for prime-rate loans—were over three times more likely to receive a subprime loan than whites. Many banks are engaging in loan modifications, but more than 70% of those modifications are leaving homeowners with more to owe on their principal, which increases their probabilities of re-default.

The bad: Most of the moratoria on foreclosures have expired, without an effective solution to the crisis in place. Last year, a bill was brought to the Senate advocating for judicial modification of loan principles (also known as “cramdown”). But the banking lobbyists flexed their too-powerful political muscles, effectively cramming down cramdown and preventing the bill from passing.

Seems grim, doesn’t it? Don’t throw your hands up quite yet.

The good: Effective solutions are out there.

Passing judicial modification legislation (or something similar)

would go a long way toward helping homeowners rebuild financially. This is something Sen.

Dick Durbin mentioned as a potential financial reform amendment, but was unable to make good on. Not exactly good news, but there is a sign of hope for future legislation in a few of our nation's largest banks having indicated support for it.

Outlawing certain predatory lending practices would also help. The recent success of the Merkley-Klobuchar Amendment, which would prohibit mortgage lenders and loan originators from receiving hidden payments when they lead homeowners into high-cost loans, and create strong underwriting standards to ensure borrowers are actually able to repay the loans they receive, is promising.

These are important first steps, but there’s much more to be done. We’d like to see extended moratoria on foreclosures, particularly those that are unemployment-induced. We’d also welcome federal stimulus funding that is targeted by level of need to reverse the current trend in which more money is flowing to communities that are less severely impacted by the recession than others.

Ending the foreclosure crisis is of critical importance in restoring the financial stability of millions of struggling Americans and preserving the wealth of those most impacted by the Great Recession.

It's safe to say that we've had our fill of the bad and the ugly. Help make good news by rallying our lawmakers around these sensible (and humane) solutions.

(For more on how to promote a fair recovery, check out these policy recommendations from our report, State of the Dream 2010: Drained.)

Making Our Voices Heard: 2010 Estate Tax Lobby Day

Lobby Day is a long-standing tradition at UFE. This two-day training and event gives UFE and RW members a chance to head down to Washington, DC and let Congress know what’s on their minds when it comes to specific policies up for debate.

Lobby Day is a long-standing tradition at UFE. This two-day training and event gives UFE and RW members a chance to head down to Washington, DC and let Congress know what’s on their minds when it comes to specific policies up for debate.

Lobby Day has been a great way for UFE to engage its supporters of the estate tax in direct action around an issue they care deeply about, and this year is no different. The next six weeks are a critical window of opportunity to stop the extension of estate and income tax breaks for the wealthiest Americans at the expense of vital investment in jobs, education and the environment.

Our 2010 Lobby Day is being co-hosted with Opinion Leaders Advocacy Network (OLAN). OLAN is an allied organization made up of progressive political donors, business leaders, philanthropists, and others who do direct advocacy for the public good on a range of issues. With the fate of the estate tax likely being decided this year, we’re giving supporters an exciting opportunity to persuade key Senators to act now to create a strong and sensible estate tax.

Participants in our previous Estate Tax Lobby Days have found speaking to members of Congress exciting and inspiring. And while it’s too late to attend this year’s Lobby Day, we encourage you to sign on to our mailing list if you’re interested in attending events like this in the future.