Photo credit: DavidDubov

The US foreclosure crisis was cause for mass hysteria leading up to the 2008 financial meltdown, and the crisis continues to this day. Despite that, the mainstream media has recently largely ignored widespread foreclosures and the deceptive and racially-discriminatory financial practices behind many of them.

Being that the housing bubble was the flimsy core of this Great Recession—and it has resulted in the biggest loss of wealth to communities of color in US history, we’d like to see this issue paid all due attention.

Today, we’ve got the good, the bad and the ugly on the foreclosures situation. We’ll start with the ugly so we can end on a high note.

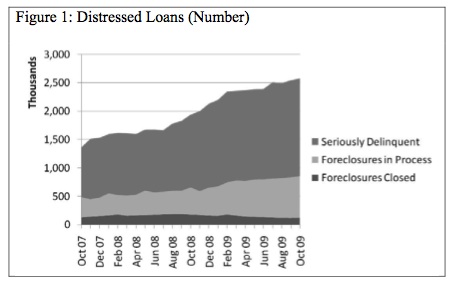

The ugly: Subprime loans were at the epicenter of the initial stage of the foreclosure crisis, and even now, foreclosure rates are holding steady at high levels that are not expected to drop any time soon. Last month, we learned that one-tenth of all US mortgages are delinquent. Of those who’ve managed to hold onto their homes, one in four is “underwater,” meaning they owe more than their house is actually worth (January 2010 data).

Chart h/t Rortybomb

Communities of color are most impacted by this prolonged crisis, because high-cost home lending was racially targeted. People of color—including many who solidly qualified for prime-rate loans—were over three times more likely to receive a subprime loan than whites. Many banks are engaging in loan modifications, but more than 70% of those modifications are leaving homeowners with more to owe on their principal, which increases their probabilities of re-default.

The bad: Most of the moratoria on foreclosures have expired, without an effective solution to the crisis in place. Last year, a bill was brought to the Senate advocating for judicial modification of loan principles (also known as “cramdown”). But the banking lobbyists flexed their too-powerful political muscles, effectively cramming down cramdown and preventing the bill from passing.

Seems grim, doesn’t it? Don’t throw your hands up quite yet.

The good: Effective solutions are out there.

Passing judicial modification legislation (or something similar)

would go a long way toward helping homeowners rebuild financially. This is something Sen.

Dick Durbin mentioned as a potential financial reform amendment, but was unable to make good on. Not exactly good news, but there is a sign of hope for future legislation in a few of our nation's largest banks having indicated support for it.

Outlawing certain predatory lending practices would also help. The recent success of the Merkley-Klobuchar Amendment, which would prohibit mortgage lenders and loan originators from receiving hidden payments when they lead homeowners into high-cost loans, and create strong underwriting standards to ensure borrowers are actually able to repay the loans they receive, is promising.

These are important first steps, but there’s much more to be done. We’d like to see extended moratoria on foreclosures, particularly those that are unemployment-induced. We’d also welcome federal stimulus funding that is targeted by level of need to reverse the current trend in which more money is flowing to communities that are less severely impacted by the recession than others.

Ending the foreclosure crisis is of critical importance in restoring the financial stability of millions of struggling Americans and preserving the wealth of those most impacted by the Great Recession.

It's safe to say that we've had our fill of the bad and the ugly. Help make good news by rallying our lawmakers around these sensible (and humane) solutions.

(For more on how to promote a fair recovery, check out these policy recommendations from our report, State of the Dream 2010: Drained.)

Be the first to comment

Sign in with